End-to-End Lending Solution

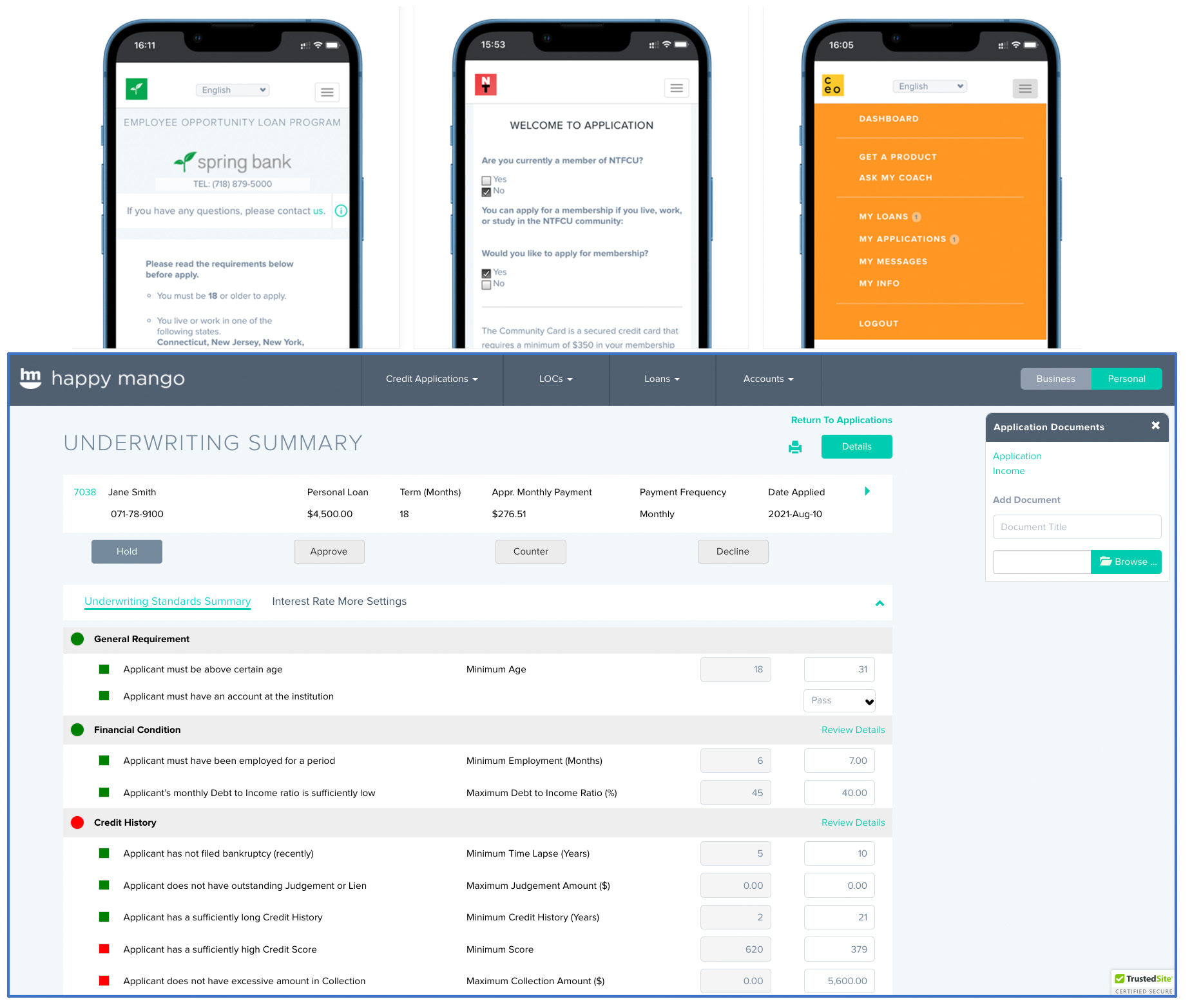

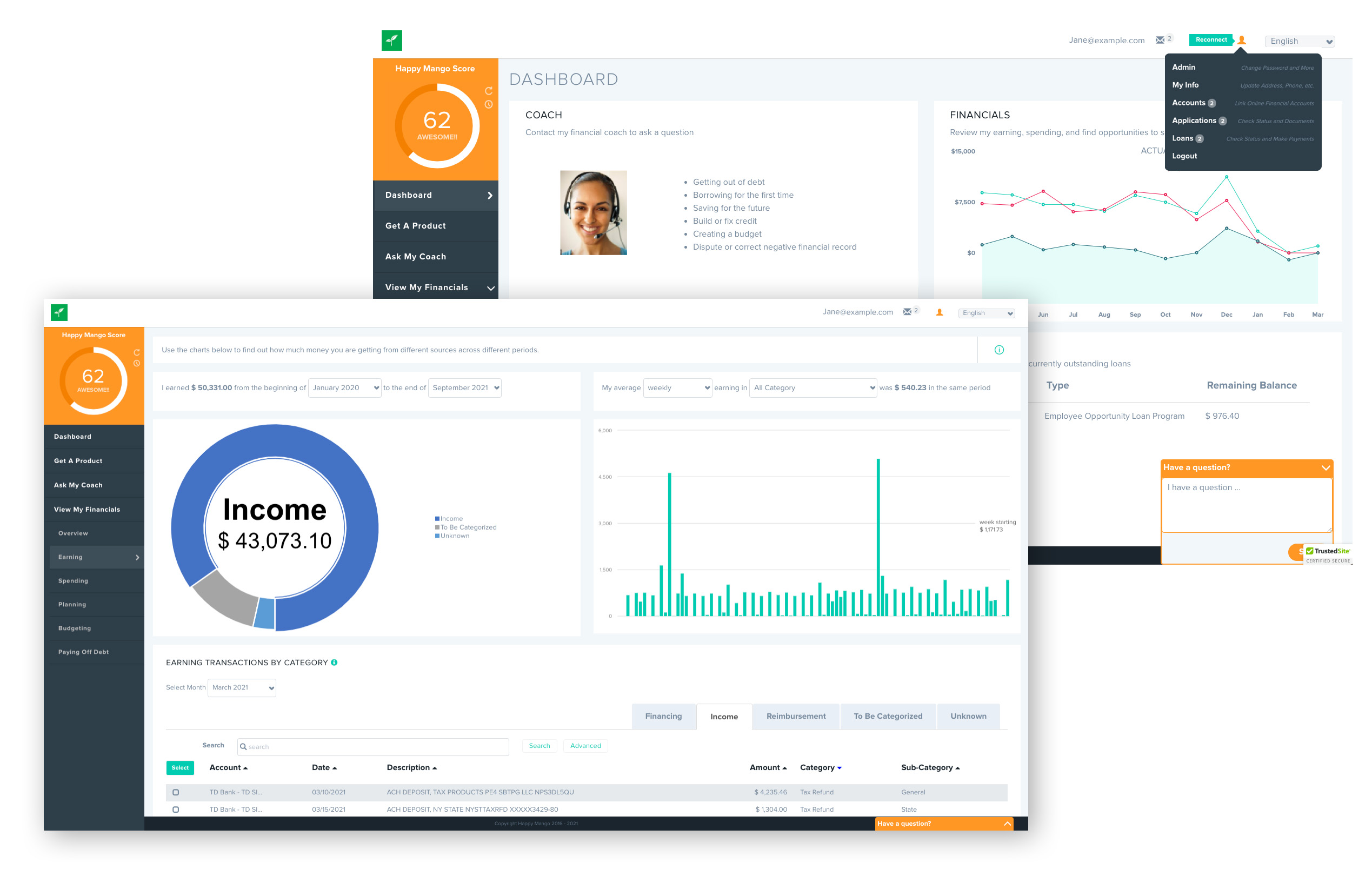

- Mobile Intake and Closing

- Consumer and Business Loans

- Automated Financial Analysis

- Integrated Credit Reporting

- Same-Day ACH

Impact and Growth Tool Box

- Referral Tracking

- Business Partnership

- Community Collaboration

- Online Marketing Tools

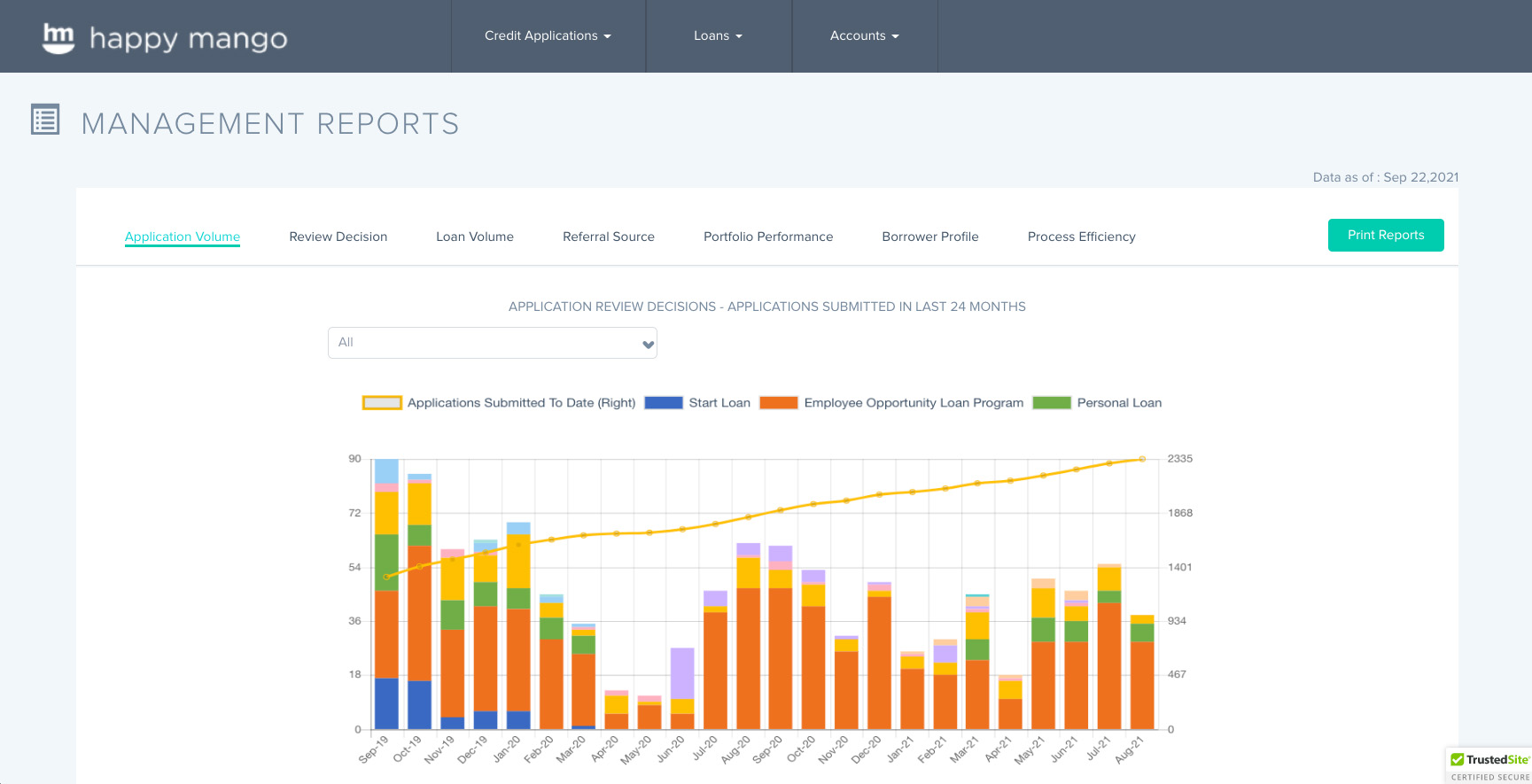

- Impact Analysis and Reporting